What is LC?

-

LC stands for Letter of Credit, also known as letter of credit. This is a letter to the bank created at the request of the importer (buyer). The purpose of a letter of credit is that the importer commits to pay the exporter (seller) a certain amount of money at a specific and fixed time. A letter of credit only appears when the exporter presents a full set of payment documents in accordance with the terms in the letter of credit.

-

Normally the exporter will also have a separate representative bank and they will transfer all valid documents to their representative bank in the country. exporter.

-

So it can be understood that LC is a way to pay for goods in import and export. The exporter and the bank are the individuals participating in this letter of credit (LC) payment process.

What is the relationship between LC and foreign trade contracts?

-

It can be simply understood that foreign trade contracts are the basis for letters of credit (LC). This is the main connection between foreign trade contracts and LCs. However, when the LC is issued, it will exist independently of the foreign trade contract and will not affect the foreign trade contract.

-

Specifically, after the foreign trade contract is signed, the buyer (importer) will rely on the content and agreements in the contract and use it as the basis for to the bank (importing country) requesting to issue a letter of credit to commit to payment to the exporter.

-

After issuing the LC, if the exporter agrees and accepts payment by letter of credit, they will then have to fully fulfill the stipulated LC obligations. to receive full payment.

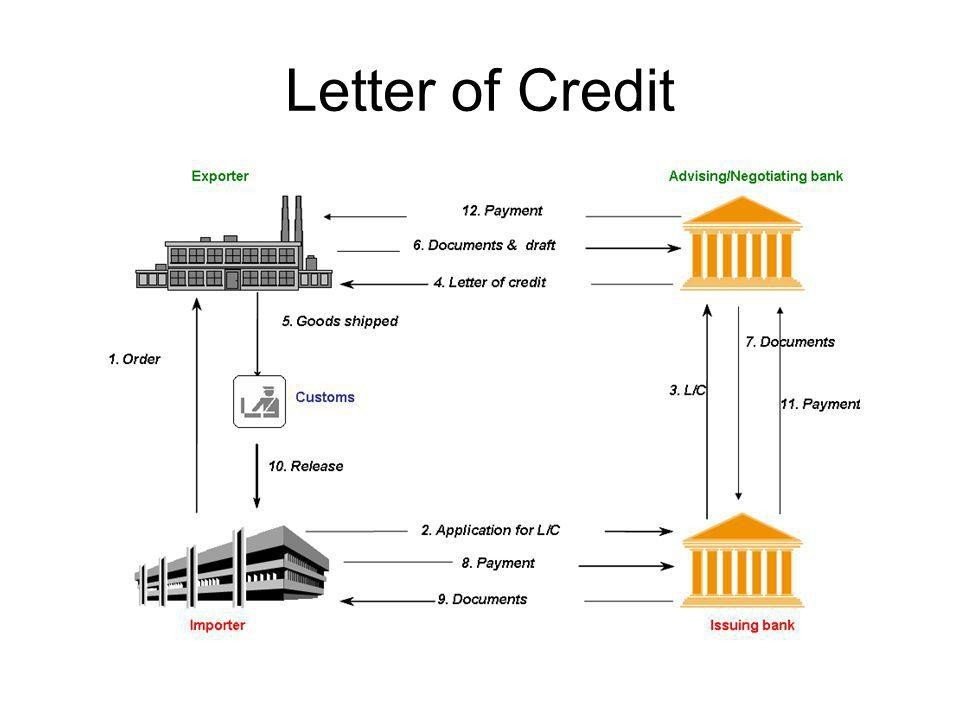

Standard procedure when paying by LC

For standard LC payment processes, there will be the participation of 4 parties including:

- Importer (buyer): This is the importing party, also known as the buyer. In LC, they are called the person requesting to open the letter of credit. (the applicant)

- Exporter (Seller): This is the exporter or also known as the seller. In the LC they will be called the beneficiary

- LC issuing bank (Issuing bank): Is the bank representing the importer.

- LC Advising Bank (Advising bank): The seller's Advising bank.

After the exporter and importer complete the signing of the foreign trade contract and both parties accept payment by letter of credit, the payment process by LC will take place. The full letter of credit payment process will include 10 steps. Specifically, the steps are as follows:

- Step 1: The buyer makes a request to open an LC at his bank (issuing bank)

- Step 2: The issuing bank will review the request. When the request is accepted, the LC will be sent to the advising bank to send to the beneficiary. Note that the advising bank must have a correspondent relationship with the issuing bank to be able to check the authenticity of the LC.

- Step 3: The notifying bank checks and evaluates the LC. Then send the original LC to the beneficiary. The seller carefully checks the LC and makes corrections if necessary.

- Step 4: After checking and confirming the LC, the beneficiary will send the goods to the importer.

- Step 5: After the goods have been delivered, the exporter will prepare valid documents for the notifying bank along with a demand notice.

- Step 6: After receiving the set of documents, the advising bank will check whether the documents are valid. A valid set of documents must comply with UCP (The Uniform Customs and Practice for Documentary Credits) and ISBP (International Standard Banking Practice for the Examination of Documents Under Documentary Credits).

- Step 7: After the notifying bank confirms the valid set of documents, it will be transferred to the issuing bank for checking. The issuing bank is responsible for notifying the advising bank of the inspection results.

- Step 8: After step 7, the set of documents will be in the hands of the issuing bank. If there are errors, the notifying bank will be responsible for requesting correction. If valid, the notifying bank will notify the beneficiary and make payment to that beneficiary.

- Step 9: The issuing bank proceeds to issue the payment notice to the importer.

- Step 10: The importer pays and transfers money to the LC issuing bank.

Main content of LC

Most types of letters of credit will have the following specific information:

- Location, opening date, number of letter of credit.

- Type of letter of credit

- Names and addresses of related parties

- Amount and currency

- Validity period, payment period, delivery period

- Delivery terms: place of delivery, delivery conditions...

- Detailed information of goods: product name, quantity, weight, packaging...

- Documents the beneficiary must present: draft, commercial invoice, bill of lading, insurance documents, certificate of origin...

- Commitment of bank to open LC

- Other related content.

LC types

Letter of credit is divided into many different types to be suitable for all payment cases when importing and exporting goods. The types of LC you can see specifically are as follows:

- Revocable L/C

- Irrevocable L/C

- Confirmed L/C

- Transferable L/C

- Back to Back L/C

- Revolving Letter of Credit

- Standby Letter of Credit

- Reciprocal L/C

- Letter of credit with red clauses (Red Clause L/C)

Advantages and disadvantages of L/C (letter of credit)

LC letter of credit is a payment method that brings many advantages in payment between exporters and importers. You can refer to the advantages of letters of credit for each party.

Benefits of LC for exporters

- According to the letter of credit, the bank will make payment to the exporter in accordance with the regulations stated in the letter of credit even if the importer does not pay.

- Minimize restrictions in transferring documents.

- Payment is also made immediately or on a specified date after the documents are transferred to the LC issuing bank.

- In particular, customers can request to advance LC money to facilitate the preparation of other procedures.

Benefits of LC for importers:

- Only when the goods are shipped does the importer have to make payment. This way you can avoid risks related to transporting goods.

- The importing party will be assured that the exporting party will have to follow all the provisions in the LC to receive payment for the goods (if not done correctly, money will be lost)

- the exporter will have to do everything according to the provisions in the L/C to ensure that the exporter will be paid (otherwise the exporter will lose money).< /li>

Disadvantages of LC

- The payment method by letter of credit in general has a disadvantage: the checking and confirmation process must be very detailed and meticulous. Both importers and exporters must be careful in preparing documents. Even a small mistake can result in payment being refused. It is quite easy to understand that if there are errors in the documents and the bank does not check them, the issuing bank will suffer huge losses.